We buy and sell the following Pre-IPO shares

Our Services

Ensure You Receive High-Quality Services

At Ten Plus One Wealth, we turn ambition into action and vision into value.

Whether you’re raising capital, exploring acquisitions, or seeking smarter investment avenues, we guide you through every step — with insights that matter, connections that open doors, and strategies that deliver.

Pre-IPO investments

Unlisted securities present a compelling alternative to public markets, offering access to high-growth startups and untapped opportunities—with the potential for greater returns.

Startup Fundraise

From strategic planning to investor introductions, we provide end-to-end support tailored to your entrepreneurial journey—empowering your startup to grow and confidently navigate the complexities of fundraising.

Mergers and Acquisitions

Our Mergers & Acquisitions Advisory service delivers expert, strategic guidance to help you navigate complex transactions and achieve your growth objectives.

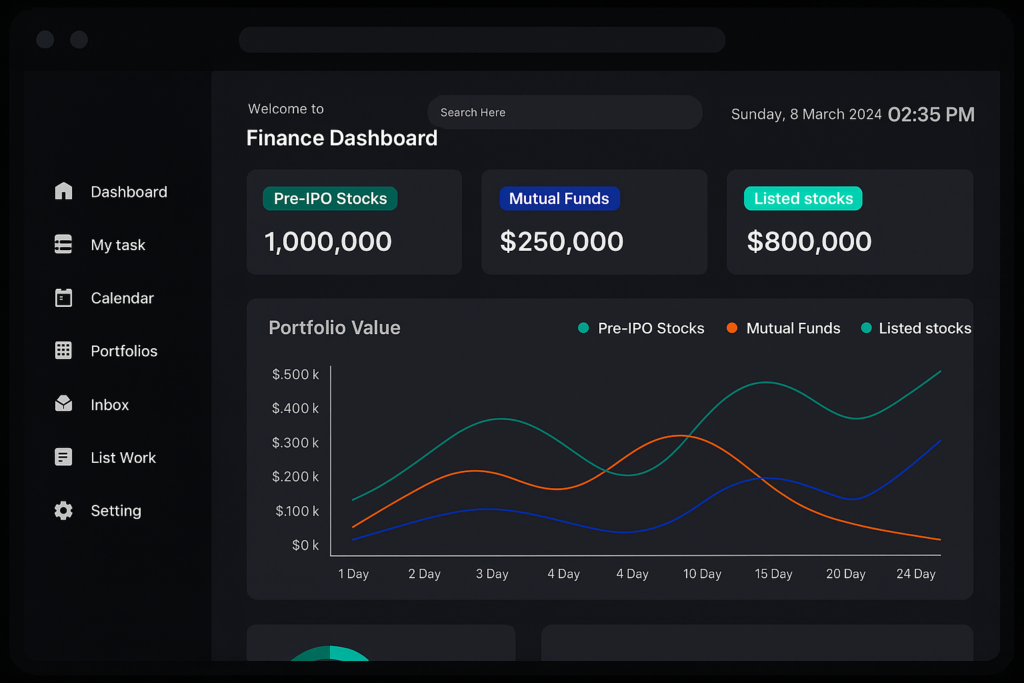

Mutual Funds

Our Mutual Funds service offers a smart, accessible way to invest across equity, debt, and hybrid schemes—tailored to your goals, risk profile, and time horizon. With expert guidance, SIP and lump-sum options, and ongoing portfolio support, we help you build a diversified investment strategy with ease.

Featured News

Newest news on Leading Pre-IPO Companies

IPO

IPO rush in H2 2025: NSDL, HDB Financial, Tata Capital among top listings to watch in 2025

India’s IPO market is rebounding in 2025 with major companies like NSDL, HDB Financial, and Tata Capital planning significant public listings. This resurgence reflects improved investor sentiment and regulatory support, marking a pivotal year for capital market expansion in the country.

Testimonials & Reviews

Hear From Our Happy Clients: Their Stories

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco.

Henry Benzamin Clark

Fitness Coach

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco.

Lexy Coxtera

Content Writer

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco.

Robert Mathew

Product Owner

Blogs

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

FAQ

Maximize Your Investment Potential Before the Crowd Joins In

Investing in Pre-IPO and Unlisted shares offers a unique opportunity to be part of a company’s growth journey before it hits the public market. These early-stage investments can unlock exceptional returns and portfolio diversification, especially for investors who want to go beyond traditional equity markets.

However, since these opportunities come with their own set of risks and regulatory nuances, it’s crucial to understand how they work, how you can invest, and what to expect.

Here are some of the most frequently asked questions to help you navigate the world of unlisted and pre-IPO investing in India:

What are Pre-IPO shares?

Pre-IPO shares are the shares of a company that are available for purchase before the company goes public through an Initial Public Offering (IPO). These are generally sold to investors like institutions, HNIs, or through specialized platforms.

What are Unlisted shares?

Unlisted shares are equity shares of companies that are not listed on any recognized stock exchange in India (like NSE or BSE). These companies are privately held and can range from startups to mature firms.

How can I invest in Pre-IPO or Unlisted shares?

You can invest through authorized intermediaries or platforms like ours that deal in unlisted/pre-IPO shares. These are generally bought and sold via off-market transactions, supported by proper documentation and demat transfer.

Is it legal to buy and sell unlisted shares in India?

Yes, buying and selling of unlisted shares is completely legal in India, provided the transactions are done through proper channels and in compliance with SEBI and RBI regulations.

What are the risks of investing in unlisted shares?

Unlisted shares can be illiquid, come with limited financial disclosures, and may have higher volatility. However, they also offer high-growth potential if the company eventually lists or scales up significantly.

Can I sell my unlisted shares anytime?

Since these shares are not traded on exchanges, selling depends on market demand and buyer availability. However, we help investors with liquidity options through our partner network.

What is the minimum investment required?

The minimum investment can vary based on the company and share availability. Some deals may start from ₹25,000, while others may require ₹1 lakh or more.

Are there any lock-in periods for Pre-IPO shares after listing?

Yes. As per SEBI rules, there is generally a 6-month lock-in period for pre-IPO shares from the date of listing for non-promoter investors.

How are unlisted shares taxed in India?

If held for more than 24 months, the gain is taxed as Long-Term Capital Gain (LTCG) at 20% with indexation.

If sold within 24 months, it’s taxed as Short-Term Capital Gain (STCG) as per your income tax slab.

Where do I receive my shares after purchase?

The shares are transferred to your demat account through an off-market transfer. You must provide your DP ID and client ID for the transaction.

How do I track the performance or valuation of unlisted companies?

While there’s no daily price update like listed stocks, you can track company announcements, financials, fundraising rounds, and broker quotes to estimate value.

What happens to my shares if the company never gets listed?

If the company never lists, you continue to hold the shares as a private investor. You may still benefit from dividends, buybacks, or secondary sales if there’s demand.

Can NRIs invest in unlisted/pre-IPO shares in India?

Yes, NRIs can invest subject to RBI regulations and via proper banking/NRI demat accounts. Some companies may have additional compliance requirements.

Early access. Informed decisions. Exceptional returns.

Gain privileged access to curated opportunities across Pre-IPO deals, private equity, mutual funds, M&A, and strategic investments — guided by deep expertise and discretion.